Buyer that churned off of ZoomInfo has similar concerns ZOOMINFO C-level executive at $10M+ funded training platform However, the core product we bought from them has stood still. We know ZoomInfo has been busy on big acquisitions and integrations, offering different capabilities. We haven’t seen a huge amount more value compared to the competitors in the market who are moving forward. We would love to see the product evolving more as I mentioned, our perception is that ZoomInfo has stood still for the last year. ZoomInfo’s core product at a standstill? ZOOMINFO Pricing is definitely the biggest challenge.

The biggest challenge ZoomInfo faces each and every year when it comes to renewal is the price tag especially for the additional intent services, which are in the five-digit range. So what are buyers saying about ZoomInfo and the competition? Īs you can see in this excerpt from the scorecard, ZoomInfo scored the lowest on CSAT (customer satisfaction).

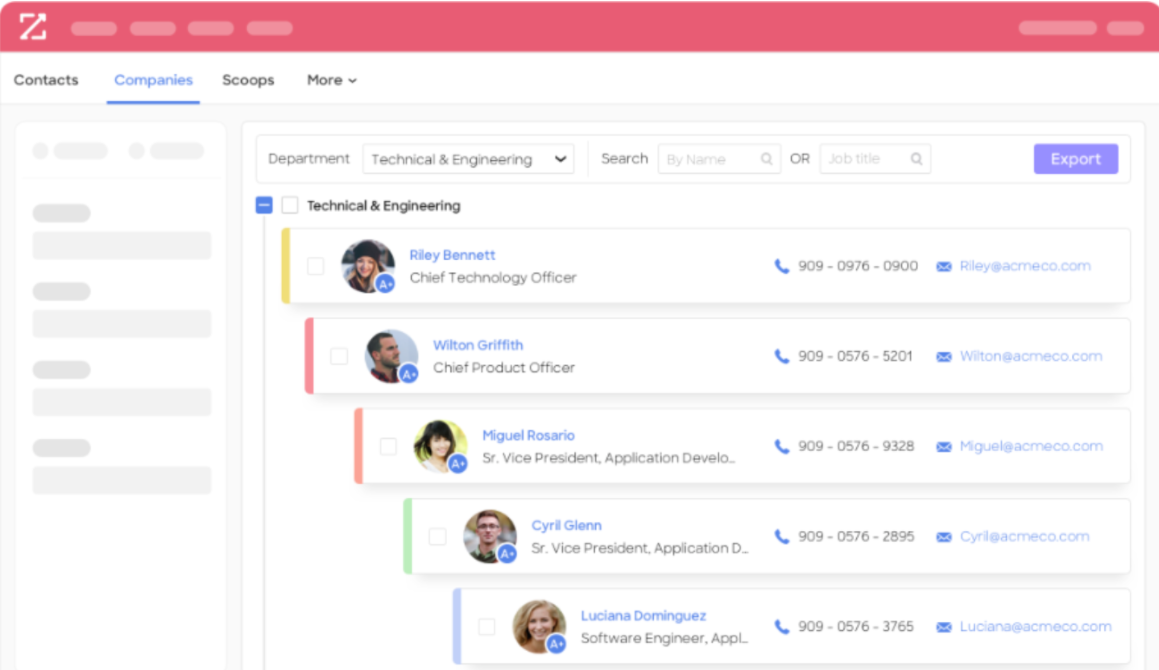

Those are summarized in this Vendor Scorecard. To get under the hood a bit, we recently partnered with Pavilion, a community of GTM leaders and their teams, and spoke to their members about their views on sales intelligence and data enrichment vendors. īut as it expands from its data roots to a full-blown sales workflow management solution, it appears customers have mixed feelings - citing challenges ranging from pricing to product innovation.Īdd in a growing cohort of challengers like Apollo.io, Lusha, and Cognism and the situation looks a bit dicey. Here’s a snapshot of its M&A activity from ZoomInfo’s profile on CB Insights. The $9.3B company is a leader in the go-to-market (GTM) intelligence space and grew revenue 47% YoY in 2022.Īnd it’s aggressively expanding into new GTM categories via acquisitions, including: The $9.3B company is a leader in the go-to-market (GTM) intelligence space and is aggressively expanding into new GTM categories - but M&A integrations may be causing the core product to suffer, according to customers we spoke with.

0 kommentar(er)

0 kommentar(er)